Practical Financial Information

INVESTING:

~Information provided by Lucas Desmond of Edward Jones~

It’s a good idea to invest (smartly) when you’re young!

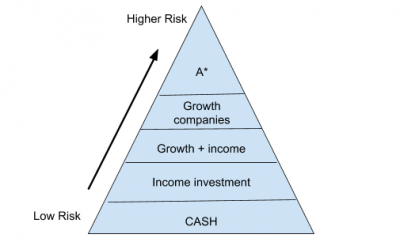

- RISK MOUNTAIN

This is Risk Mountain. It represents the different ways you can “hold” your money, and even make money instead of just sitting on it. Risk mountain sinks into the ground at the rate of inflation, averaging somewhere around 3 %. The bottom of risk mountain represents your cash holdings: there is no risk involved, but you also aren’t making any money. If you invest your income in a fairly stable company that isn’t growing, then you will often receive dividends (profit-sharing) in proportion to your stock share. Some growing companies also operate this way. However, many growing companies hold onto their profits and reinvest that revenue into the company; you receive your profit when you eventually sell your stock.

When you’re young: invest in stocks [increased value at cash out]

→ “feed” monthly: invest a part of your paycheck monthly – it won’t affect you too much now, but will pay off later!

When you’re older: invest in bonds [lend $$, receive sustained/consistent return]

Key:

Income / Growth + Income = profits distributed to shareholders instead of reinvesting profits in company. Dividends: profit sharing

Growth = use shareholder investments to build company. Profit from selling stock after accruing value *Aggressive companies that do well in emerging markets

- It’s often smart to buy when everyone is selling (dip in markets).

→ don’t buy into hype of fluctuating markets, sometimes it’s good to hold out. - Invest in multiple companies (security) → “don’t put all your eggs in one basket”

- Helpful site that evaluates companies you can invest in: http://www.morningstar.com/InvGlossary/Valuation-definition-what-is.aspx

Retirement Savings

Traditional IRA – tax deferred account → $$ not taxed until withdrawn later in life (retirement)

Roth IRA – pay initial tax, but never pay taxes again once invested (good for when you’re young!)

401K = type of IRA (by employer)

403b = 401K for nonprofits

HEALTH INSURANCE PLANS:

~Information provided by Ken Emerson of Bates Human Resources~

When you secure your first job, your employer will likely offer you a health insurance plan. They will likely have a few plans that you can choose from. Here we provide a bit of information about some typical types of health insurance plans and some tips for making sure you get the best healthcare possible.

TIPS and RESOURCES:

- Be Informed: Read all the information your employer provides and ask questions!

- Establish a PCP (primary care physician)

- Check your medical bills with your insurance statements – they should match!

- WebMD: www.webmd.com

- HealthCentral.com: www.HealthCentral.com

- Mayo Clinic: www.MayoClinic.com

- American Academy of Family Physicians: www.aafp.org

- National Institute of Health: http://medlineplus.gov

- Healthcare Blue Book: https://healthcarebluebook.com

- The Leapfrog Group: www.leapfroggroup.org

- Hospital Compare: www.medicare.gov/hospitalcompare/search.html

- Institute for Health Improvement: www.ihi.org

- Agency for Healthcare Research and Quality: www.ahrq.gov

- National Patient Safety Foundation: www.npsf.org

- National Quality Forum: www.qualityforum.org

- Quality Counts/Patient Centered Medical Home: www.mainequalitycounts.org

- Maine Health Data Organization: www.mhdo.maine.gov

- Maine Sentinel Events: www.maine.gov (search for “sentinel events)

SOME TYPICAL TYPES OF PLANS:

- Preferred Provider Organization (PPO)

→ Health plan with higher principle monthly cost, greater coverage (copay,

coinsurance), and a lower deductible.

→ relies on contracts with providers: “in network” = definitely covered by your

insurance.

**This type of healthcare plan gives you a little bit more security and requires that you

pay less out-of-pocket per medical visit (higher coverage).

- High Deductible // Health Savings Account (HSA)

→ Health plan with lower principle monthly cost, less coverage (mostly preventative

care), and a high deductible.

→ Usually paired with a Health Savings Account: contribute % of monthly earnings to

HSA (tax-free). HSA account used to cover your medical costs. Employer will often match your

investments.

** While this type of healthcare plan can be a bit more risky, it may actually be the

most cost effective! It does require more work, however: you have to keep track of

your medical expenses in a more detailed way and put in more work to make sure

you’re getting the most cost-effective care.

*All health plans have an annual out-of-pocket maximum.

TAXES:

~Information provided by Tony Tenneson and Jillian Shepard from L/A CA$H Coalition~

Who has to file income tax returns?

| FILING STATUS | GROSS INCOME AT LEAST |

| Single | $10,400 |

| Married Filing Jointly | $20,800 |

| Married Filing Seperately | $4,050 |

| Head of Household | $23,400 |

| Qualifying Widow(er) | $18,000 |

What form should I use?

1040EZ :

– Under the age of 65

– Filing status is single or married

– No dependents can be claimed

– Taxable Income < $100,000

1040A:

– Taxable income < $100,000

– Do not itemize your deductions

– Certain tax credits can be claimed

– Adjustments — Educator expenses (up $250), IRA deduction, student loan interest

1040:

Must use if:

– Taxable income > $100,000

– Have income, adjustments or credits that cannot be reported on 1040EZ or 1040A

– Itemize deductions

- Exemptions & Standard Deductions (as of 2018)

- Standard Deduction

- Single — $12,000

- Married Filing Jointly — $24,000

- Married Filing Separately — $12,000

- Head of Household — $18,000

- Qualifying Widow(er) — $24,000

- Standard Deduction

- Applicable Credits

- Earned Income Credit – refundable

- American Opportunity Credit – refundable

- Lifetime Learning Credit

- Child Tax Credit – refundable

- Child and dependent care expenses

- Retirement savings contribution credit

CREDIT:

~Information provided by Rich Goldman ’76 & Randy Creswell of Credit Abuse Resistance Education (CARE)~

What is a Credit Score?

A credit score is a statistical value that assesses an individual’s creditworthiness in an attempt to predict the likelihood that they will pay back a given loan. The credit score ranges from 450 to 850, with a higher value generally indicating a higher degree of trustworthiness.

Why do I need a credit score?

Credit scores are extremely important as they are essential for individuals to take out any kind of loan including for a house, car, etc. Some employers will even look at an individuals credit score if they are between to candidates to assess an individual’s level of fiscal responsibility.

How do I build my credit?

Credit scores are calculated based off of a wide range of factors, however the best way to build credit effectively is through opening a credit card account and using it wisely. By opening a credit card account and paying off the full amount each month, you are demonstrating fiscal responsibility, thereby building your credit.

INSURANCE

~Information provided by Dottie Chalmers Cutter and Lexi Richardson of Chalmers Insurance Group~

Having auto and property insurance is vital to protecting your assets and your financial future.

Property Insurance (Renters or Homeowners Policy) covers:

- Contents (your possessions, if damaged or lost in a covered loss)

- Loss of Use (living expenses if you cannot live in your rental space due to a covered loss)

- Personal Liability (covers bodily damage and property claims for which you are responsible)

- Medical Payments (if someone unintentionally gets injured in your rental space)

Auto Insurance includes:

- Coverage to protect others:

- Liability (Bodily Injury and Property Damage)

- Coverage to protect yourself:

- Physical Damage Coverage (Collision and Comprehensive)

- Medical Payments

- Uninsured/Underinsured Motorist