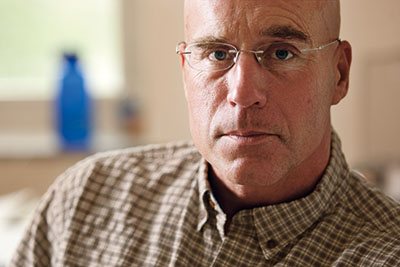

Ask Me Another: Investing in Infrastructure

In 1988, David Aschauer, then a senior economist at the Federal Reserve Bank in Chicago, made a startling claim: Government spending on infrastructure — roads, bridges, airports — could improve economic productivity. His theory “set the economics profession on its ear,” said The Atlantic Monthly.

In graph form, the historical results were dubbed “the Aschauer curve”: as infrastructure spending increased during the 1950s and 1960s so did economic productivity; as public investment ebbed into the 1980s so did productivity. Since 1990, Aschauer has held the Elmer W. Campbell Professorship in Economics at Bates, where, along with continued work on U.S. macroeconomic policy, he focuses on transitional economies in Russia and the Ukraine.

In the 1990s, your research entered the public policy realm as President Clinton pushed for more infrastructure spending to boost the economy. What was your reaction?

What became clear to me was that Clinton’s economic plan was turning words like “infrastructure” and “investment” into clichés and caricatures. If you just said, “It’s an investment,” it was automatically supposed to help the economy. That changed when Leon Panetta became Clinton’s chief of staff in 1994. He took a hawkish attitude toward the deficit, so spending on infrastructure was pushed back in order to reduce the deficit. Panetta was savvy. He knew the danger of people making a joke out of the Clinton budgetary process.

Your fiscal policy ideas are again highly relevant. What’s that feel like?

With most economists, I initially thought that using monetary policy — the supply of money — would keep us from needing a significant fiscal program. In that sense, I was skeptical of the original $168 billion tax rebate in 2008. In fact, as it turned out, the rebate appears not to have had much of an effect on the economy. It’s now troubling that the Obama administration has merely chosen a different strategy to distribute tax cuts, this time by reducing withholding. To me, it’s a little galling to try to get people to spend while, at the same time, advising us of the value of being “prudent” in our spending habits.

For years consumers were berated for spending. Now we’re being berated for not spending.

Right. Most people would argue that as a nation, over the long term, we have been consuming too much and saving too little. But once we’re in a recession, you want people to spend in order to increase aggregate demand and boost the economy. Anyone can be expected to struggle with that concept — I’ve seen President Obama struggle with it, trying to say it’s good to be frugal and save while at the same time saying we need to spend trillions to get out of this recession.

Are consumers saving through fear or as a positive strategy?

My personal feeling is that there will be a long-term, persistent effect on consumption behavior due to this experience. Saving is related to investing, and when we save too little, there’s too little investment, or investment becomes financed by China and other countries.

Didn’t economists understand way back, even during the New Deal, that government spending on infrastructure would stimulate the economy?

Those policies were to create jobs, not to boost the long-term growth rate of the economy. In fact, I see too much focus on jobs and employment in the current recovery plan. Look at the entire Recovery.gov site: The plan’s success is explained in terms of jobs saved and created. A more substantive and preferable way would be to show how this spending is going to play out in terms of future productivity gains.

So what would keep you from writing an article for the popular press on that topic?

I’m confident that Obama people, people like Larry Summers, know this.

Is the Obama administration guilty of caricaturizing infrastructure spending?

No. At the same time, they hope that other spending programs — while not lumping them in with “infrastructure,” they are calling them “investments” — will have significant positive effects. They’ll be making that argument with healthcare spending proposals later this year.

Won’t spending on healthcare, such as computerizing records, boost productivity?

I do believe that spending federal money to computerize healthcare records will improve efficiency. But the question is this: If it’s going to have a productive effect, why hasn’t the private sector done it already? The larger problem is the gross inefficiency of U.S. healthcare. The system doesn’t have the incentive to economize on its own because it can largely raise prices to cover the cost of inefficiency.

Why did you move away from doing more work on U.S. infrastructure?

My research strategy is horizontal, not vertical. I said what I wanted to say about infrastructure, then moved on.

Any regrets?

Had I produced more information on infrastructure at the U.S. macroeconomic level we might have found ourselves eight months ago with more information about all these shovel-ready projects. We could have known which ones would have the strongest effects on productivity, rather than just calculating jobs.

That sounds quite self-critical.

I’m an economist. I look at the opportunity cost: academic papers that I could have been writing while I chose to study in Russia and Europe. Ex post facto, it might’ve been a better use of my time and it might have been beneficial to the country had I continued on. But that’s the past.

Interview by H. Jay Burns, photograph by Phyllis Graber Jensen