Sprintax Information

International Students will need to complete a Tax Status Analysis using Sprintax. The Tax Status Analysis must be completed each year or upon any change of immigration status. Please use the Sprintax guide we have created to answer common questions we receive, or the Sprintax manual as you fill out your profile.

SEO sends all international students access to their Sprintax account in August before their first-year. You should set this up upon receiving the email regardless of your plans to work on campus. Even if you do not intend on holding a student employment position, the Tax Status Analysis is essential for tax purposes on any scholarships, awards, prizes, or other money you may receive from Bates.

Your Bates email is your username, and you will be prompted to set up your password. Log in to your profile to add your personal information. For more information or questions, you can utilize the Live Chat feature in Sprintax or contact the Payroll Office at payroll@bates.edu.

Once you are hired, if you have not already set your account up, SEO will send you an activation email to log in to your Sprintax account.

Answer “yes” to applying for a social security card and that you are legally authorized to work in the US.

The “Progress” section on the left side of the screen will be red if there is required information that needs to be entered. Once a page is complete, the progress section will be green with a checkmark.

Please review and sign the tax forms that are generated once you enter all required information. In order to sign the tax forms, you will be prompted to Download the Google or MS Authenticator mobile app, scan the QR code Sprintax generates, and enter an authentication code generated by the app. Information regarding the 2FA process can be found on our Sprintax 2FA Information page. Completed forms can be electronically signed using the e-sign functionality or may be printed, signed and uploaded into the document exchange in your Sprintax profile.

If you are applying for an on-campus job, once we receive the Adobe forms and you have completed your Sprintax account we will send you an email to set up an appointment with us. We will have tax forms for you to sign. You will be given a job offer letter and your social security application to take with you to the Social Security Office to apply for your card.

FAQs

Which Income Codes should I use?

As a student you will potentially receive payments associated with Income Codes 16 (fellowship/scholarship), 20 and 23 (awards). Estimate an amount for each. If you have no idea, put $100.00. This information will be used to complete your tax status analysis to determine your tax residency status for the upcoming year.

What documents may I need to refer to complete my profile?

You may need your Employment Authorization Card – I-766 (I-20), Notice of Action-I-797, Visa, passport, SSN, and/or US TIN.

Do I need a U.S. Bank Account?

Yes, you will need a U.S. bank account . Direct Deposit is a requirement of employment so you will need a bank account before you begin to work. If you have a US bank account please click the following link for instructions and set up your Direct Deposit in Garnet Gateway.

https://www.bates.edu/student-employment/files/2022/01/Direct-Deposit-Instructions.pdf

Which login option do I choose?

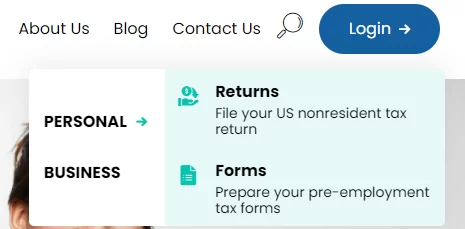

From the Sprintax homepage, in the top right-hand corner highlight “Login,” select Personal, and click on Forms.

What do I enter as the date I intend to leave the US/final departure date if I do not exactly know?

Enter the expiry date on your I-20 (F1 Visa)

What do I enter for my US Address?

Your US Address is your PO Box from Post and Print.