Community Capital

An innovative new Economics course called “Finance and Society,” led by Dr. Anamika Sen, completed its first semester this past April, showcasing how students can apply financial concepts to address real-world community opportunities and needs. This community-engaged learning (CEL) course, developed by Dr. Sen in partnership with the Harward Center, proved to be a significant success, and it’s set to continue this fall with new students and many of the same community partners.

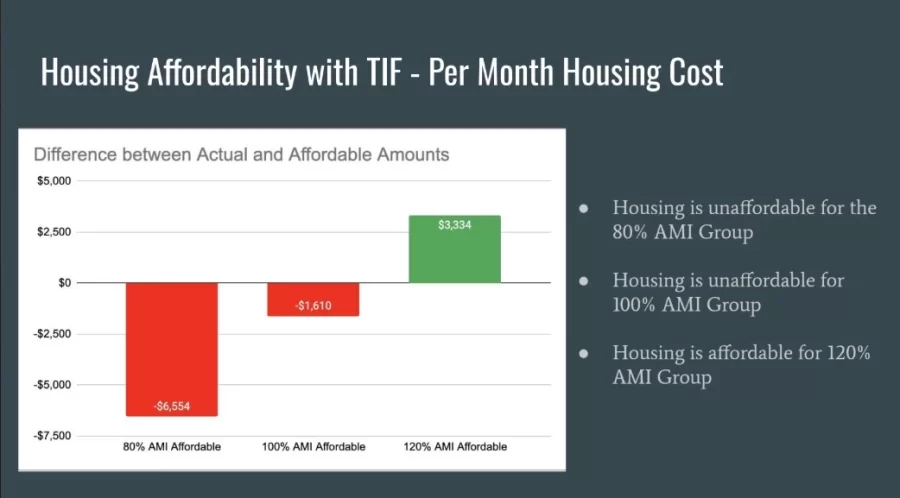

Dr. Sen designed “Finance and Society” to be a hands-on experience, moving beyond theoretical discussions to direct engagement with community-based questions of finance. “I did not have any reference points for what a community-engaged finance course would even look like so it was a lot of experimenting and risk-taking, which I’m glad to say paid off immensely!” Dr. Sen shared. A finance course was also new territory for the Harward Center, but we were happy to find that many community partners had relevant questions and problems for the students to dive into. From “What level of financial support do we need to make Tax Increment Financing a viable path to homeownership for families in the Tree Streets of Lewiston?” to “What is currently offered locally for financial literacy training and what gaps might Androscoggin Bank help to fill?,” community partners both old and new jumped on the opportunity to work with students in this topic area that impacts many community development efforts across Lewiston Auburn.

Five student teams partnered with local organizations, tackling diverse financial issues. These collaborations involved working with the Lewiston Housing Authority, Androscoggin Bank, Community Credit Union, Raise-Op Housing Cooperative and the City of Lewiston Housing Committee, and First 4 ME and the Cooperative Development Institute. The course incorporated scaffolded CEL writing assignments to keep students actively working on their projects and engaging with their partners throughout the semester. The culminating event was a final presentation, where community partners saw the excellent work student groups accomplished.

The projects spanned a range of critical community needs, two focusing on financial literacy and accessibility. For instance, students developed financial literacy materials for residents of the Lewiston Housing Authority, covering essential topics like avoiding predatory lending, car and home purchasing strategies, and budgeting. Other projects delved into innovative financial solutions and research for specific community challenges. Students collaborated with the Community Credit Union to research the feasibility and structure of a citizenship loan product aimed at supporting immigrant community members with the costs associated with seeking U.S. citizenship. This involved detailed investigation into the various costs and timelines involved in the naturalization process.

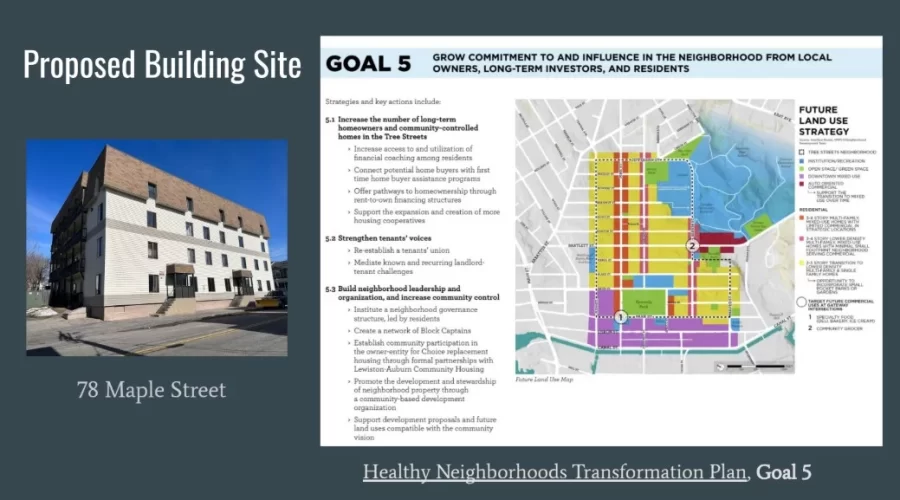

Two more projects involved looking at finance solutions for increasing home ownership in downtown Lewiston and for childcare cooperatives. Working with the Raise-Op Housing Cooperative’s Craig Saddlemire (Bates Class of 2005), the homeownership-focused team researched Tax Increment Financing (TIF) as a strategy. This team not only conducted extensive research on the TIF model but was treated to a walking tour to see specific areas where new affordable housing is proposed. Their work culminated in a presentation of their TIF findings to local decision-makers on the Lewiston Housing Committee, directly contributing to community discussions.

After spending the semester deeply engaged with these diverse projects and partners, one student’s reflection truly captured the essence of the course’s impact: “This course reshaped how I view finance—not just as a system of numbers, but as a powerful social force. I learned how financial structures like credit and banking can reinforce inequality, and I was especially inspired by our discussions on community-based financial models that center trust and collective care. Overall, the class pushed me to think critically and connect economics with social justice, helping me grow as a more thoughtful and engaged student.” This sentiment highlights Dr. Sen’s primary goal: for students to understand the significant role finance can play in addressing societal challenges.

The success of this first iteration of “Finance and Society” has set a strong foundation. Dr. Sen, the Harward Center, and community partners alike are enthusiastic about future iterations, believing they will only continue to build both our partners’ capacity and our students’ knowledge of how finance impacts critically important issues in our society.